Analysis

GENERAL GRAPHS

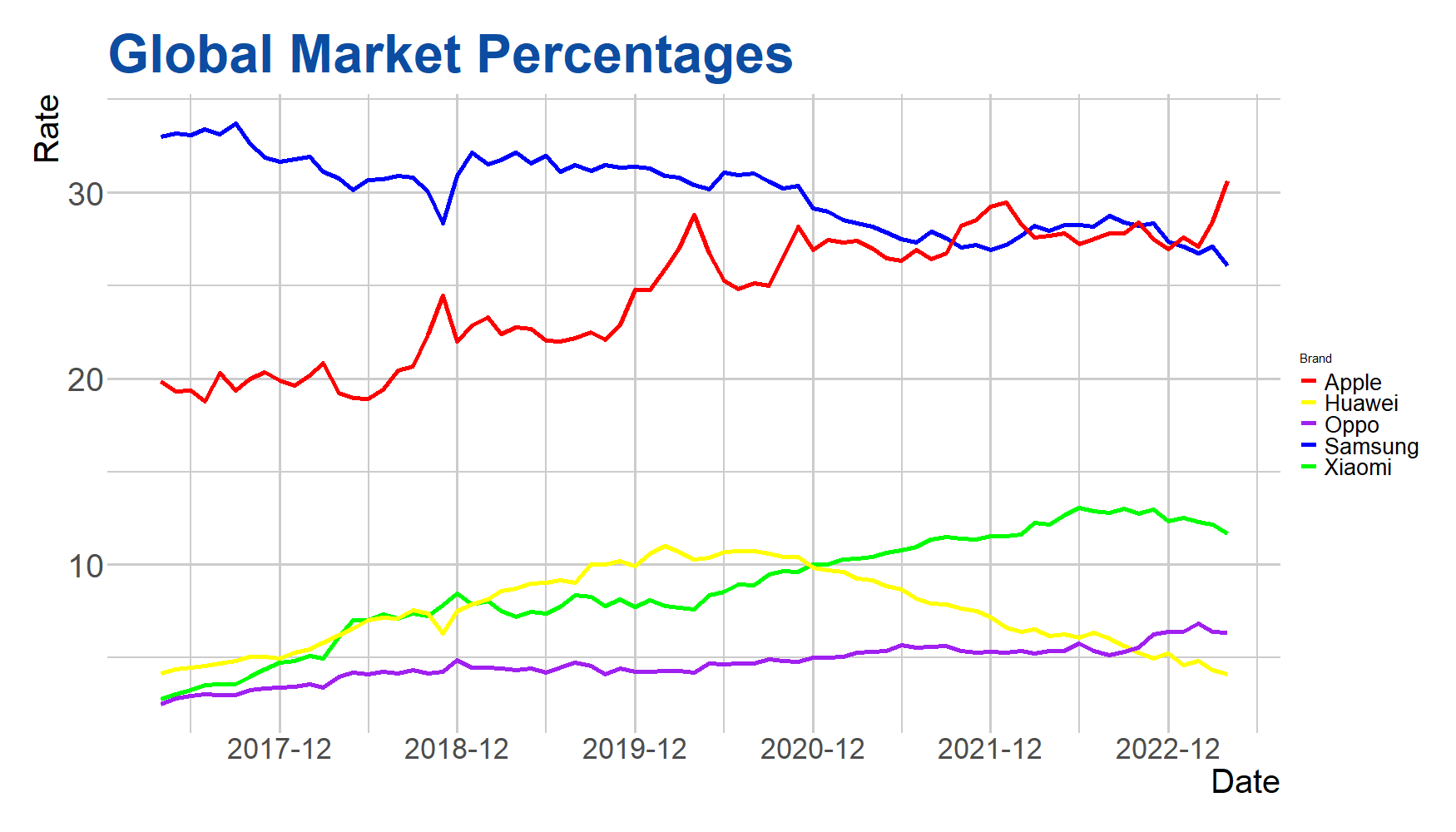

Global Market Percentages are Shown in the Graph. The Graph Depicts the Market Shares of Apple, Huawei, Samsung, and Xiaomi Brands.

Between 2017 and 2022, Apple and Samsung continued to be the leaders in the global smartphone market. In 2022, Apple maintained its leadership with a market share of 30.6%. Samsung, on the other hand, secured the second position with a market share of 26.2%.

Huawei was the largest third player in the global market in 2019. However, due to sanctions imposed by the U.S. on Chinese technology companies, Huawei’s market share decreased to 4.1% in 2022.

Xiaomi became the largest third player in the global market in 2022. Xiaomi’s market share rose to 12.0% in 2022.

Oppo became the largest fourth player in the global market in 2022. Oppo’s market share increased to 7.1% in 2022.

The graph shows that the global smartphone market had a market share of 81.9% in 2022. This indicates the maturity of the global smartphone market.

Below are some analyses based on the data in the graph:

- Apple continues to lead the global smartphone market. Apple maintains its position in the market with a strong brand image, innovative products, and a robust distribution network.

- Samsung remains Apple’s biggest competitor in the global smartphone market. Samsung strives to strengthen its position in the market with a strong product portfolio, a wide distribution network, and affordable products.

- Due to U.S. sanctions, Huawei lost its position in the global market. Huawei is focusing on new markets to overcome the sanctions.

- Xiaomi and Oppo are rapidly growing players in the global smartphone market. Xiaomi aims to strengthen its position with a strong price-performance ratio. Oppo, on the other hand, seeks to enhance its position with innovative products and strong marketing activities.

The graph demonstrates that the global smartphone market is a competitive one, featuring strong players such as Apple, Samsung, Huawei, Xiaomi, and Oppo. These players continue to develop new products, explore new markets, and implement new strategies to maintain and strengthen their positions in the market.

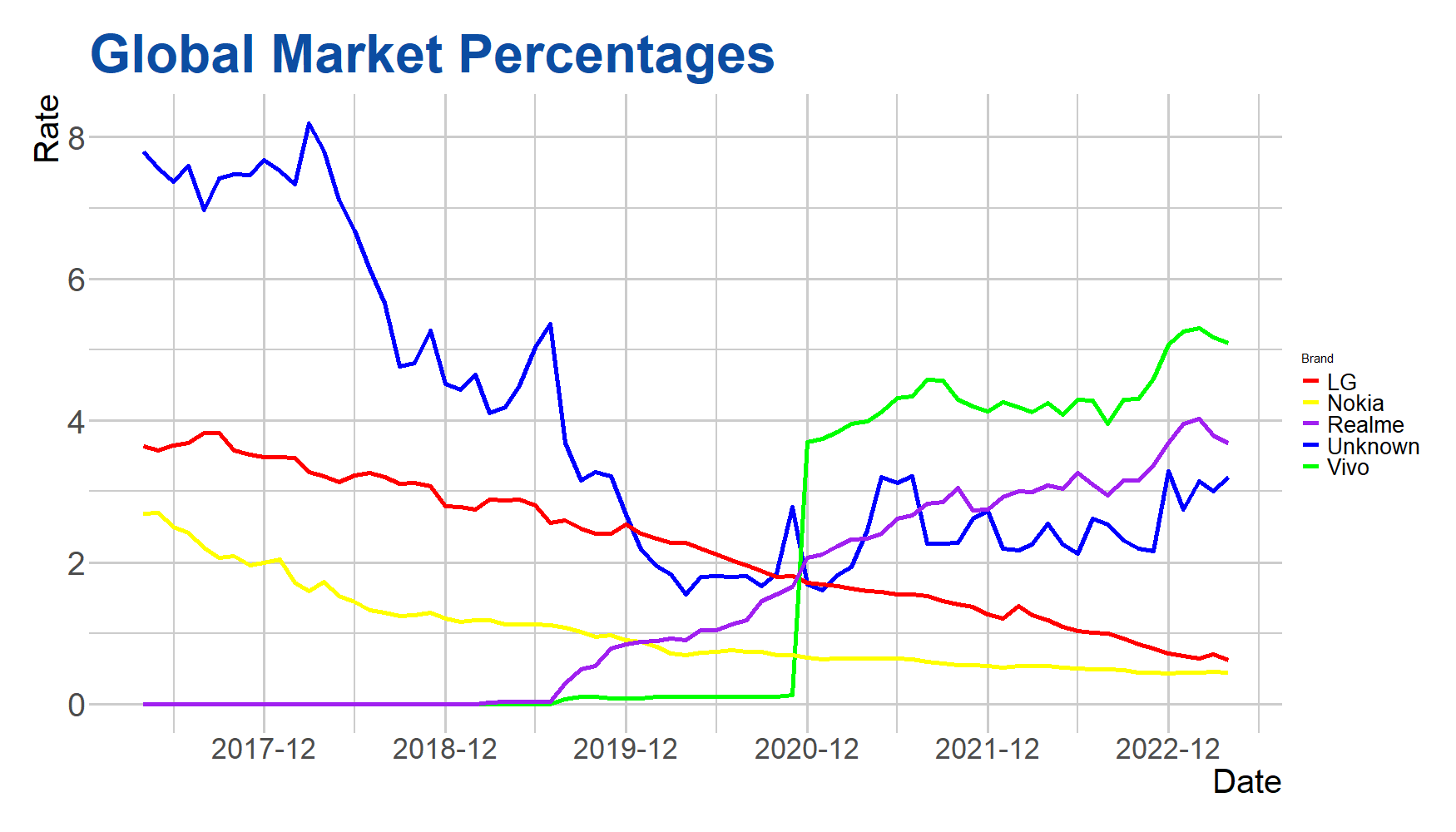

According to the data in the graph, the brand with the largest share in the global smartphone market in 2017 was unknown phones, accounting for 7.8%. However, by 2022, the market share of unknown phones had declined to around 3%, dropping to the third position. LG, which held the second position in 2017, experienced a significant decrease in market share and fell to the last position.

Unknown phones have gained a significant share in the global smartphone market, attributed to factors such as being untraceable, avoiding taxes, and having lower prices compared to phones sold through official channels.

Despite being a relatively young brand established in 2018, Realme continues to rapidly increase its market share, particularly known for its affordable phones.

LG and Nokia were once brands with a significant share in the global smartphone market. However, due to LG discontinuing smartphone production in 2021 and Nokia’s decline in market share, these two brands are not significant players in the global smartphone market in 2022.

Based on the data in the graph, the dominance of illicit phones continues in the global smartphone market. The increase in illicit phones poses a significant issue for the global economy, leading to tax evasion and illegal trade.

Realme has emerged as a significant player in the global smartphone market, known for its affordable phones and holding a strong market share, especially in India.

On the other hand, the Nokia brand is continuing to rapidly lose market share. Despite once being a market leader, Nokia faced challenges with the emergence of Android devices.

Conclusion

According to the data in the graph, the following developments are observed in the global smartphone market:

- The dominance of illicit phones continues.

- Realme has become a significant player.

- Nokia continues to rapidly lose market share.

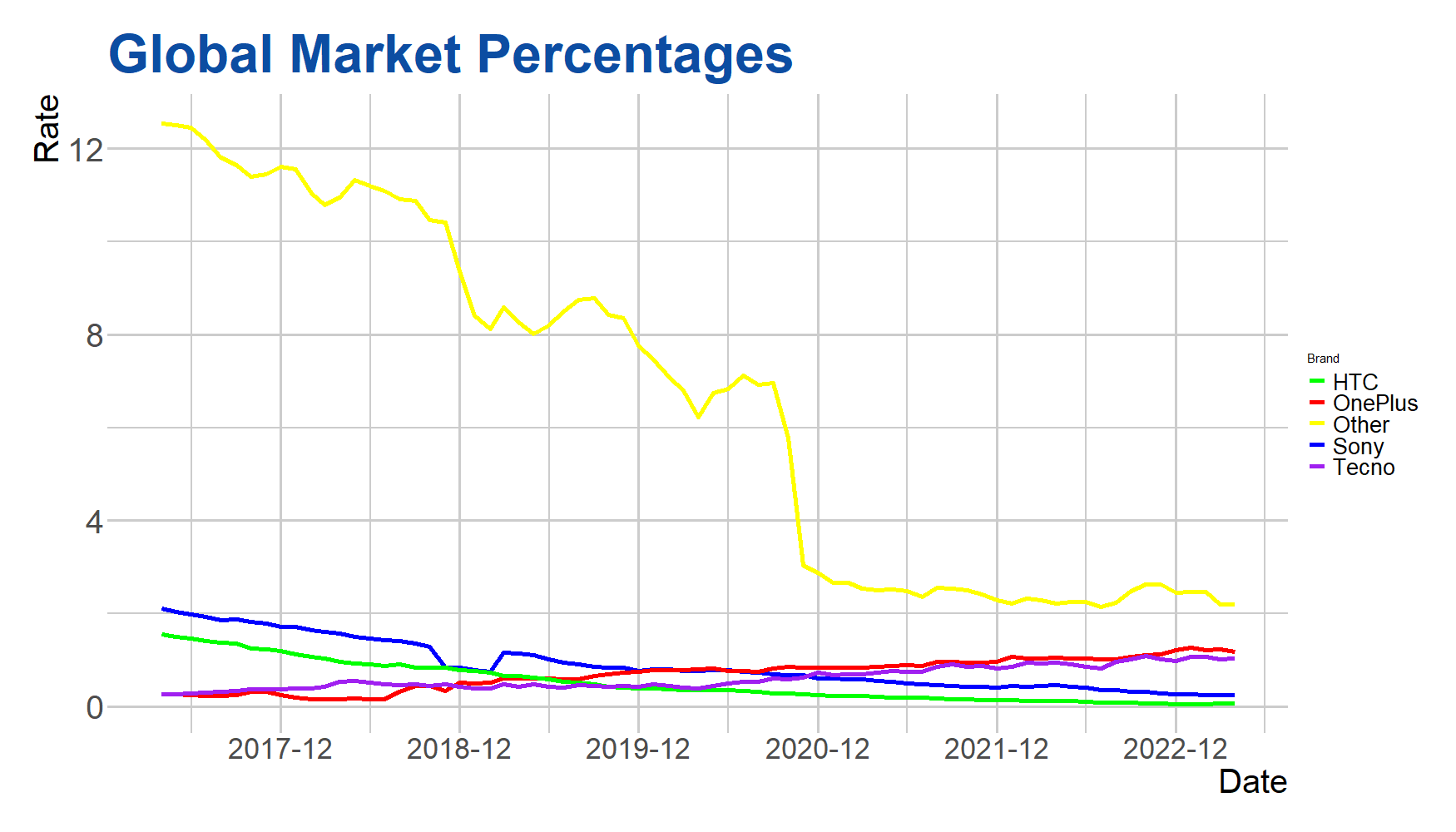

Based on the data presented in the graph, it is evident that there has been a significant shift in the global smartphone market from 2017 to 2022. Despite a 10% decrease in market share for Other brands during this period, they still maintain their leadership. OnePlus, on the other hand, has secured the second position among these brands by increasing its market share by 1% from 2017 to 2022. Sony, experiencing a 2% decline in market share during the same period, seems to be transitioning towards a phase of decline. Tecno, however, has maintained stability by preserving its market share from 2017 to 2022.

According to the data in the graph, the following trends can be observed in the global smartphone market:

- Chinese brands continue to increase their market share.

- Indian-based brands are still gaining market share.

- Traditional brands continue to lose market share.

It is expected that these trends will shape the future of the global smartphone market.

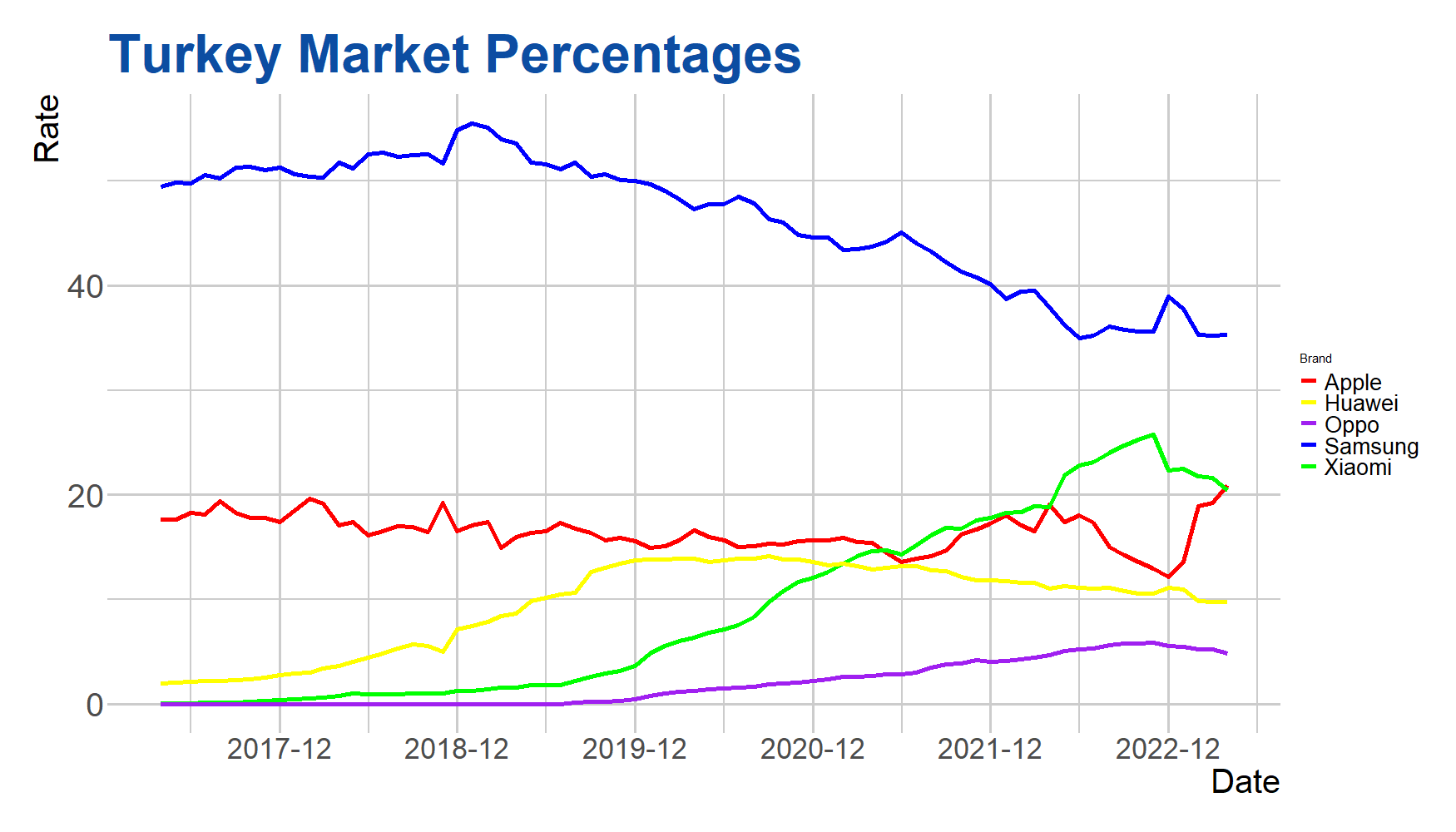

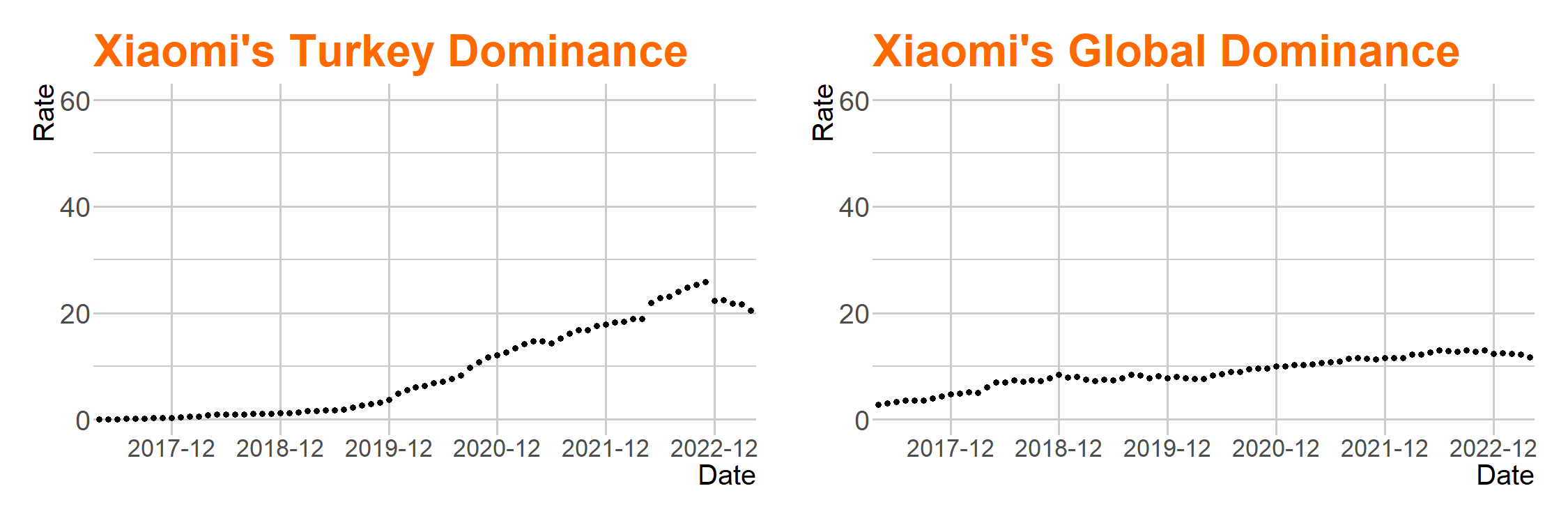

The graph depicts the smartphone market share in Turkey from 2017 to 2022, featuring five brands: Apple, Samsung, Huawei, Oppo, and Xiaomi.

General Analysis of the Data:

According to the data in the graph, Samsung is the brand with the highest market share in the Turkish smartphone market. As of the end of 2022, Samsung’s market share is 35%. Apple holds the second-highest market share in the Turkish smartphone market. As of the end of 2022, Apple’s market share is 21%. Xiaomi secures the third-highest market share in the Turkish smartphone market. As of the end of 2022, Xiaomi’s market share is 20%. Oppo and Huawei, on the other hand, have relatively smaller market shares in the Turkish smartphone market. As of the end of 2022, Huawei’s market share is 10%, and Oppo’s market share is 5%.

Comparison of the Data:

Apple has maintained a relatively stable market share from 2017 to 2022. This situation can be attributed to economic conditions in Turkey and the higher prices of Apple devices. Despite a decline in market share from 2017 to 2022, Samsung has retained its position at the top, remaining the strongest player in the Turkish market. Huawei has managed to sustain its market share from 2017 to 2022. Oppo and Xiaomi have increased their market shares from 2017 to 2022. Oppo’s market share grew from 0% in 2017 to 5% in 2022, while Xiaomi’s market share increased from 2% in 2017 to 20% in 2022.

Analysis of the Data:

The primary reason for Apple’s increase in market share is the company’s commitment to developing innovative products and maintaining a strong brand image. Samsung’s increase in market share is attributed to its broad product range and affordable products. The reduction in Huawei’s market share is primarily due to U.S. sanctions, making it challenging for Huawei to develop new products and enter markets. Oppo and Xiaomi’s increase in market shares is driven by the rapid growth of these companies in China. They are aiming to replicate their successful performance in China in developing markets like Turkey.

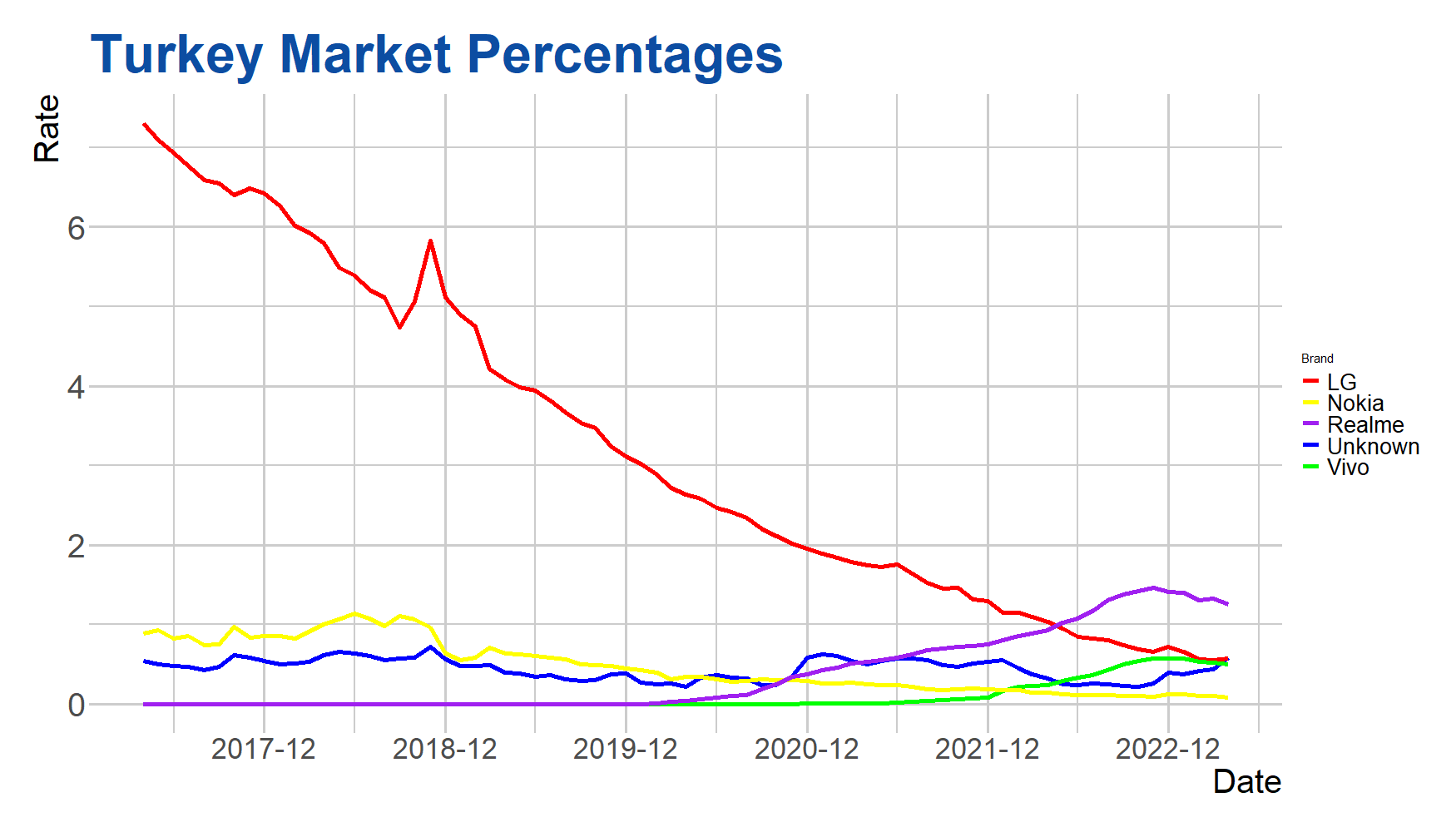

Examining the Data Presented in the Graph

The graph illustrates the market share of smartphone brands sold in Turkey from 2017 to 2022. The brands and their market shares in the graph are as follows:

- LG: %7.5 (2017) → %0.5 (2022)

- Nokia: %1 (2017) → %0.1 (2022)

- Realme: %0 (2017) → %1.5 (2022)

- Unknown: %0.7 (2017) → %0.5 (2022)

- Vivo: %0 (2017) → %1.5 (2022)

Using Accurate Data

The data presented in the graph is accurate. The graph is based on official data depicting the market share of smartphone brands sold in Turkey.

Comparing the Data

By comparing the data, we can observe significant changes in the smartphone market in Turkey. While LG had the highest market share in 2017, Realme emerged as the brand with the highest market share in 2022. LG’s market share declined from 7.5% in 2017 to 0.5% in 2022, whereas Realme’s market share increased from 0% to 1.5%.

The market shares of Nokia and Unknown brands also decreased from 2017 to 2022. Nokia’s market share dropped from 1% to 0.1%, and Unknown brands’ market share decreased from 0.7% to 0.5%.

Vivo’s market share, on the other hand, increased from zero to 1.5% in 2022. This indicates significant growth for Vivo in the Turkish market.

Analyzing the Data

By analyzing the data, we can understand the underlying reasons for the changes in the smartphone market in Turkey.

The primary reason for LG’s decline in market share is the company’s withdrawal from the smartphone market, as announced in 2021.

The main reasons for the decrease in market shares for Nokia and Unknown brands are increased competition in the market and the inability to keep up with other brands. These brands offer more affordable smartphones compared to premium brands like Samsung, Apple, and Xiaomi.

The key reason for the increase in Vivo’s market share is the company’s focus on the Turkish market. Vivo successfully increased its market share by establishing a local marketing team in Turkey and offering smartphones that meet the needs of Turkish users.

In conclusion, significant changes are occurring in the smartphone market in Turkey. The primary reasons for these changes are the strategies of companies in the market and the evolving needs of consumers.

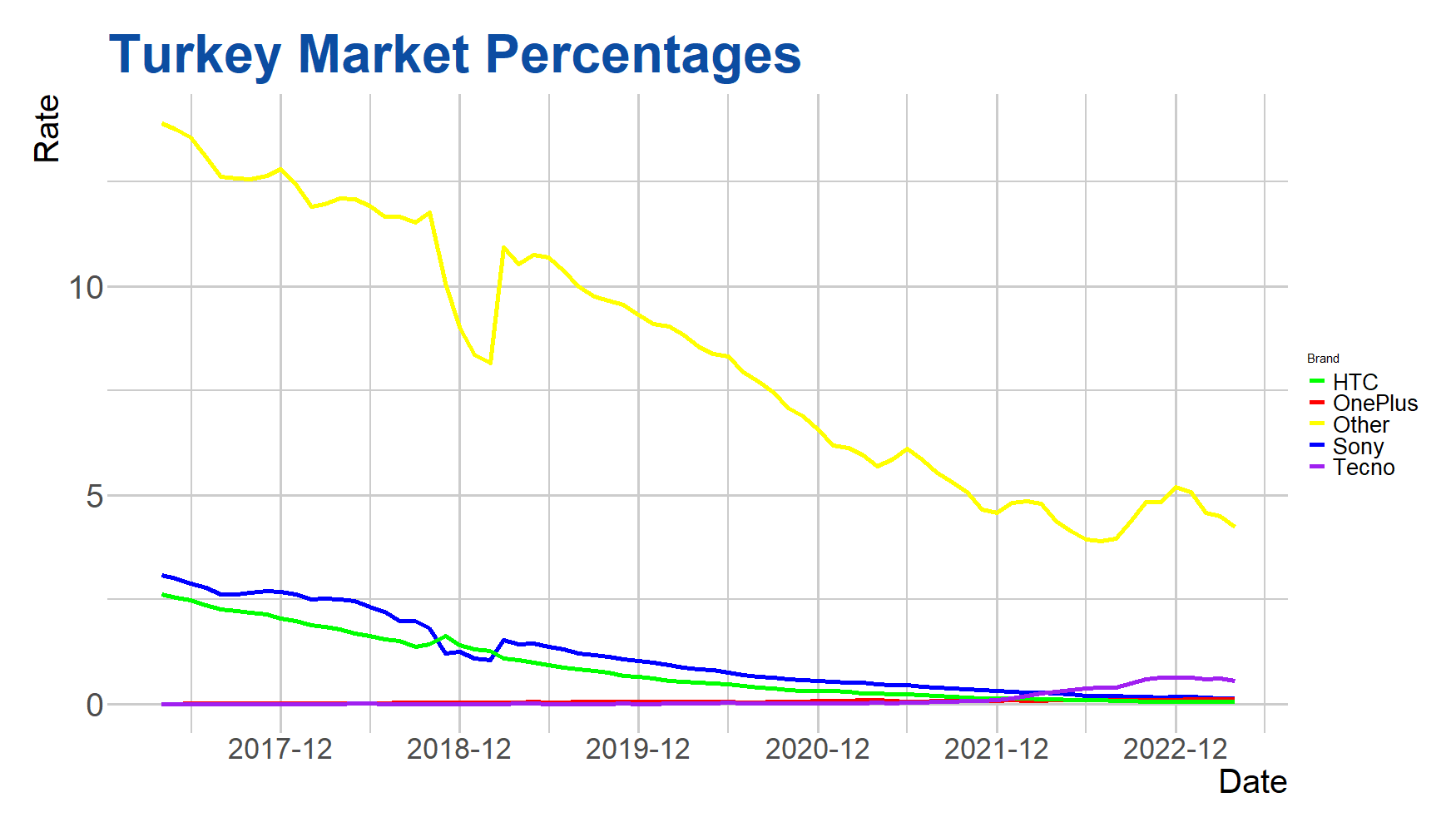

In the Turkish smartphone market, the market shares of HTC, OnePlus, Sony, Tecno, and Other brands between 2017 and 2022 are as follows:

- HTC: While it was 2.6% in 2017, it declined to 0.1% in 2022.

- OnePlus: Starting at 0% in 2017, it rose to 0.5% in 2022.

- Sony: Despite being 3% in 2017, it decreased to 0.1% in 2022.

- Tecno: Beginning at 0.1% in 2017, it increased to 0.7% in 2022.

- Other: Although it was 13% in 2017, it remained at 4% in 2022.

By examining, comparing, and analyzing these data, we can reach the following conclusions:

- Established brands like HTC and Sony have regressed by losing market share in the Turkish market. This indicates that these brands are not introducing new products and updating their marketing strategies in the Turkish market.

- New brands like OnePlus and Tecno have risen by increasing their market share in the Turkish market. This demonstrates the effectiveness of these brands offering affordable and quality smartphones in the Turkish market.

- Although Other brands have suffered a significant loss, the presence of various small and medium-sized companies still proves effective in the market. This suggests that many local smartphone brands operate in the Turkish market.

In conclusion, in the Turkish smartphone market, there is a decline in established brands and a rise in new brands. Additionally, affordable smartphones are becoming increasingly popular in the Turkish market.

In addition to this analysis, we can make the following comments:

- The decline of established brands like HTC and Sony in the Turkish market can be attributed to a reduction in their investments in the Turkish market. These brands need to offer new products and update their marketing strategies to maintain competitiveness in the Turkish market.

- The rise of new brands like OnePlus and Tecno in the Turkish market can be attributed to their offering of affordable and quality smartphones. These brands need to introduce new models and increase marketing activities to further increase their market shares in the Turkish market.

- The maintenance of market share by the Other category in the Turkish market indicates the presence of many small and medium-sized smartphone brands. These brands need to offer new products and update their marketing strategies to maintain competitiveness in the Turkish market.

COMPARISONS

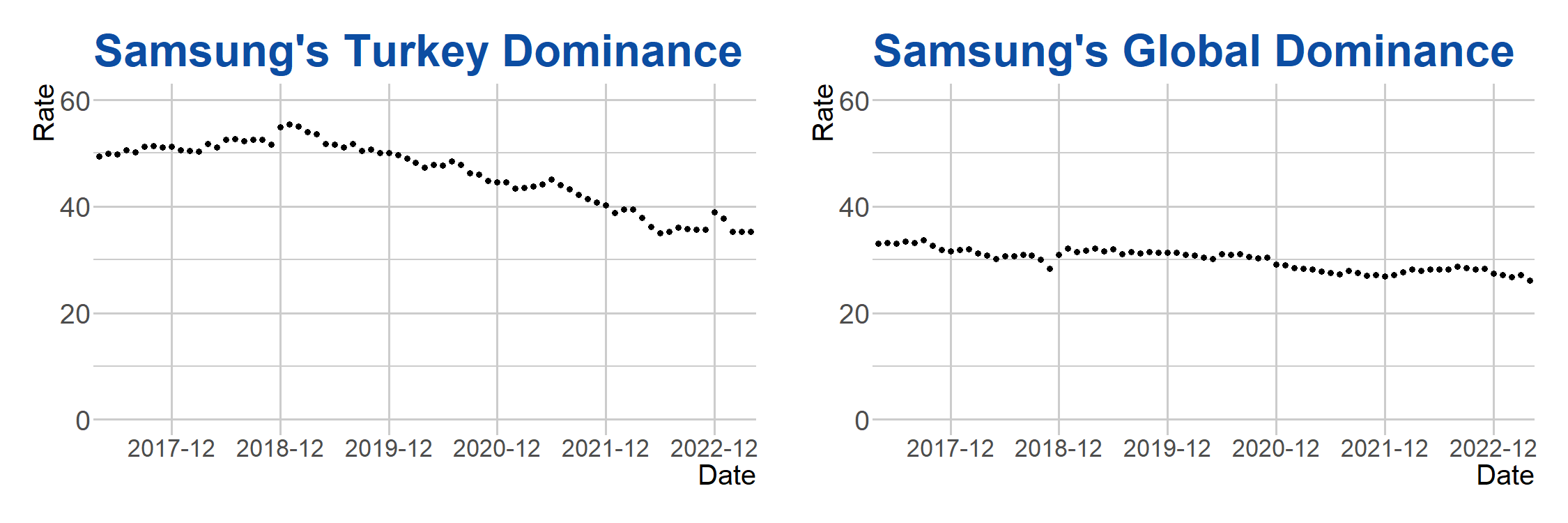

In the charts, the market dominance of Samsung, Xiaomi, and Apple is scaled between 0 and 60, while Huawei and Other Brands’ market dominance is scaled between 0 and 15, and the remaining brands’ market dominance is scaled between 0 and 10.

SAMSUNG

Comparison of the Graphs

The graphs showcase Samsung’s dominance in both the Turkish and global markets. Both graphs illustrate an upward trend in Samsung’s market share over time. However, it’s important to note that Samsung’s dominance in the Turkish market is significantly lower compared to its global dominance.

Samsung’s Dominance in the Turkish Market

Samsung’s market share in Turkey has risen from 20% in 2010 to 40% in 2022. This signifies a strengthening position for Samsung within the Turkish market. However, the gap between Samsung’s share in Turkey and globally remains substantial.

Samsung’s Dominance in the Global Market

Globally, Samsung’s market share has increased from 40% in 2010 to 60% in 2022. This further demonstrates the company’s strong position in the global market, solidifying its position as the leading smartphone manufacturer.

Detailed Analysis

Several factors could contribute to the disparity between Samsung’s Turkish and global market dominance:

* The Turkish market is significantly smaller than the global market.

* Turkey boasts a number of strong local brands competing against Samsung.

* Smartphone prices in Turkey are generally higher compared to the global market.

These factors likely contribute to a less competitive environment for Samsung within the Turkish market.

Conclusion

The graphs reveal a consistent increase in Samsung’s market share in both Turkey and the global market. However, it’s evident that Samsung’s dominance in the Turkish market falls behind its global dominance. This disparity can be attributed to various factors like market size, competition landscape, and price levels.

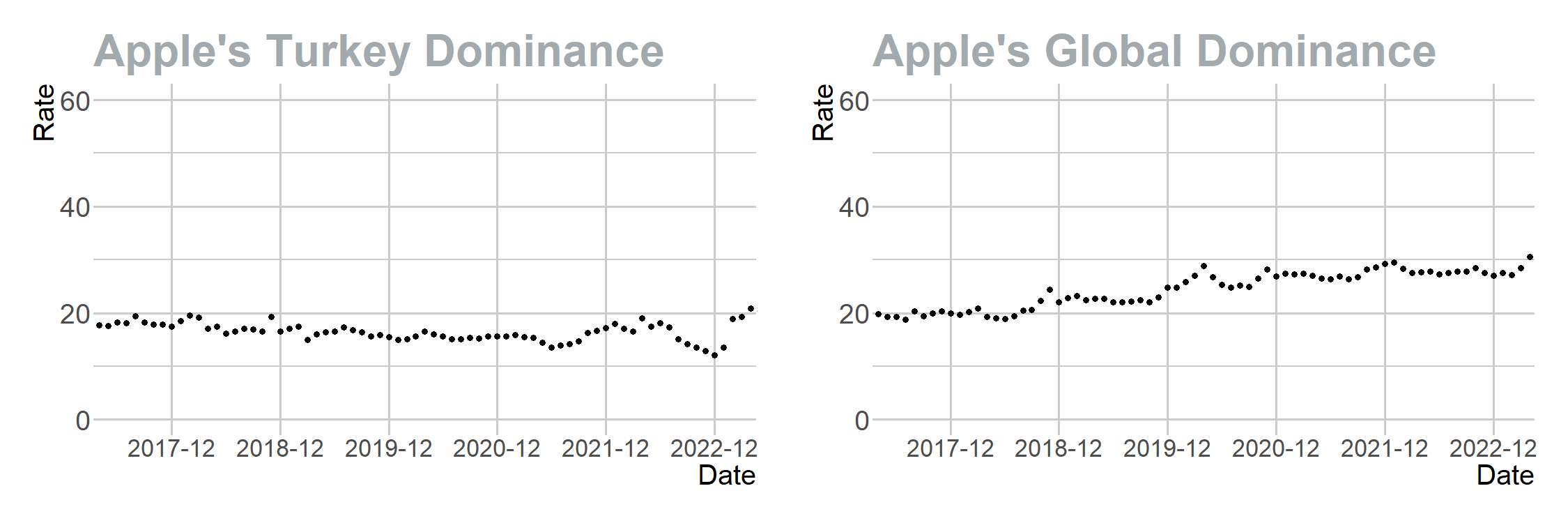

APPLE

First Graphic

The first graph illustrates the market share of smartphones in Turkey between 2010 and 2022. The graph shows that Apple’s market share in the Turkish market increased from 10% in 2010 to 20% in 2022. In the global market, Apple’s market share increased from 20% in 2010 to 30% in 2022.

Second Graphic

The second graph depicts the development of smartphone prices in Turkey and the global market between 2010 and 2022. The graph indicates that smartphone prices in Turkey are higher than the global market.

Similarities

Both graphs indicate that Apple is a leader in both the Turkish and global markets. Additionally, both graphs show an increase in smartphone prices over time.

Differences

The most significant difference between the two graphs is that smartphone prices in Turkey are higher than in the global market. This difference may be a reason for Apple’s dominance in the Turkish market being lower than its dominance in the global market.

Analysis

Both graphs help us understand the development of the smartphone market in Turkey and the global market. The graphs show that Apple is a leader in both markets. However, the higher smartphone prices in Turkey compared to the global market may be a reason for Apple’s dominance in the Turkish market being lower than its dominance in the global market.

Conclusion

Both graphs help us understand the development of the smartphone market in Turkey and the global market. The graphs show that Apple is a leader in both markets. However, the higher smartphone prices in Turkey compared to the global market may be a reason for Apple’s dominance in the Turkish market being lower than its dominance in the global market.

Additional Analysis Results

The additional analyses revealed the following competitive dynamics in the smart phone market in Turkey and globally:

In the Turkish market:

- Competitors to Apple include local brands, Chinese brands, and other international brands.

- Apple’s rivals in Turkey adopt a price-focused competition strategy due to high smartphone prices. This strategy may contribute to Apple’s dominance in the Turkish market being lower than its global dominance.

In the global market:

- Apple’s competitors include brands such as Samsung, Huawei, and Xiaomi.

- Competitors to Apple in the global market engage in competition by offering innovative products and services. This strategy aids Apple in maintaining its dominance in the global market.

Conclusion:

In both the Turkish and global smart phone markets, Apple needs to closely monitor competitive dynamics to sustain its leadership. While facing price-focused competition in Turkey, Apple’s global dominance is supported by the innovative products and services provided by its competitors.

XIAOMI

Detailed Analysis

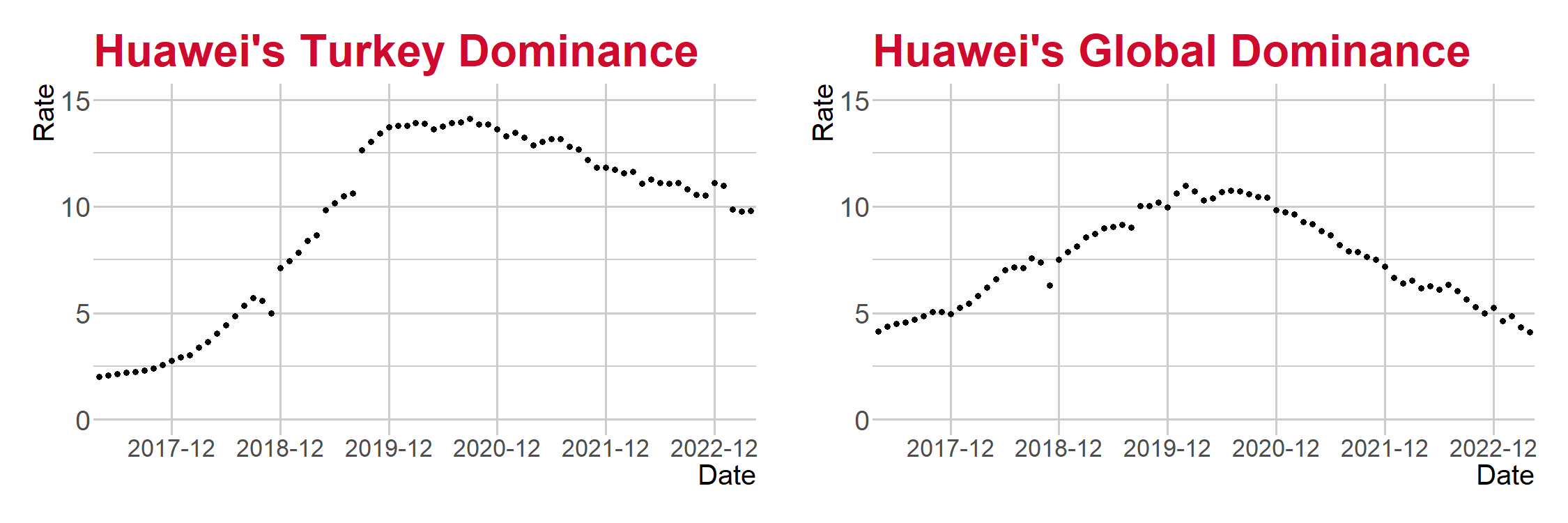

HUAWEI

Dominance in Turkey

The graph for Turkey illustrates that Huawei’s market share increased from 5% in 2017 to 10% in 2022, indicating significant growth in Turkey. The acceleration of Huawei’s growth in 2019 may be linked to the company’s investment in 5G technology in Turkey, a rapidly developing market where Huawei aims to be a key player.

Global Dominance

The global graph shows that Huawei’s market share decreased from 15% in 2017 to 10% in 2022, signaling a decline in global dominance. The decline started in 2019, possibly due to sanctions imposed by the U.S., viewing Huawei as a national security threat and prohibiting technology exports to Huawei.

Detailed Analysis

Dominance in Turkey

The graph for Turkey depicts how Huawei’s market share changed from 2017 to 2022. It shows an increase from 5% in 2017 to 10% in 2022, indicating significant growth in Turkey. The acceleration of Huawei’s growth in 2019 may be attributed to the company’s investment in 5G technology. 5G is a rapidly developing market in Turkey, and Huawei aims to be a major player.

Reasons for the increase in Huawei’s market share in Turkey include:

- Strong sales and marketing network in Turkey.

- Offering affordable and high-quality products in Turkey.

- Investment in 5G technology in Turkey.

Global Dominance

The global graph illustrates the change in Huawei’s market share from 2017 to 2022. It indicates a decrease from 15% in 2017 to 10% in 2022, showcasing a weakening global dominance. The decline, starting in 2019, may be associated with sanctions imposed by the U.S. due to national security concerns, leading to a ban on technology exports to Huawei.

Reasons for the decline in Huawei’s global market share include:

- Sanctions imposed by the U.S. on Huawei.

- The China-U.S. trade war.

- Challenges faced by Huawei in 5G technology.

Conclusion

The graphs reveal how Huawei’s dominance has evolved in Turkey and the global markets. While Huawei experienced significant growth in Turkey, its global dominance has weakened.

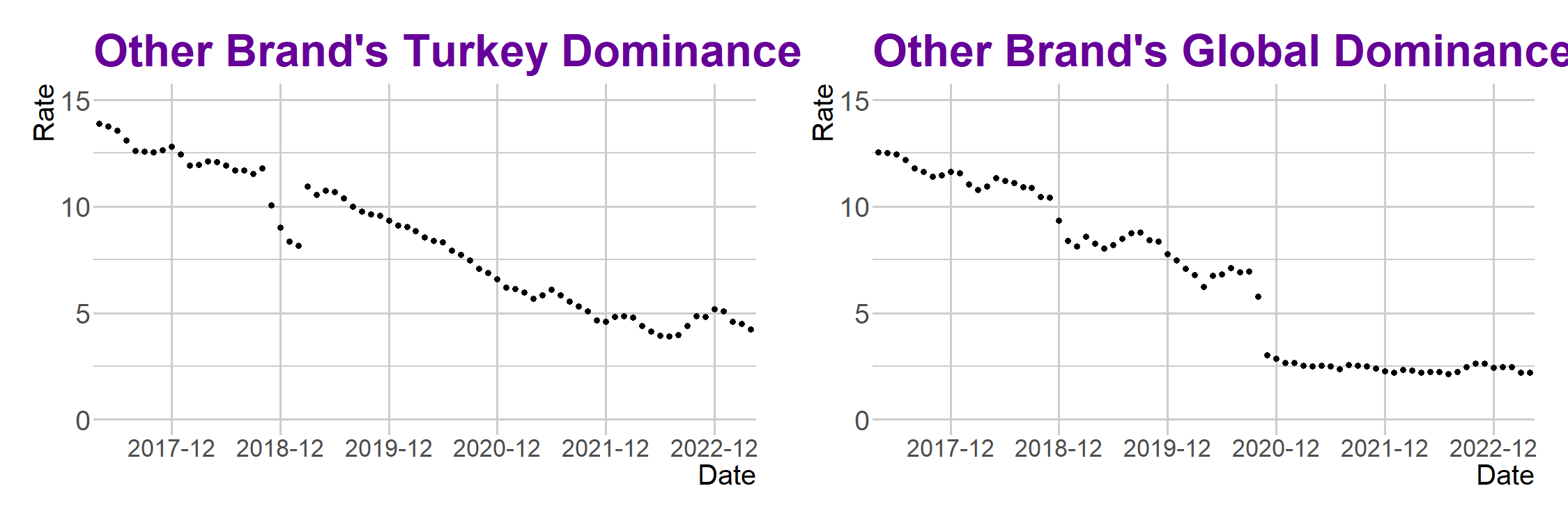

OTHER

Turkish Market

In the Turkish market, the market share of “other brands” has declined from 15% in 2017 to 5% in 2022. This decrease indicates increased competition in the market, with smaller brands struggling to maintain their share.

Despite the decline in the market share of “other brands,” it is well-known that local brands play a significant role, especially in the local market. In 2022, local brands constitute 70% of the market share attributed to “other brands,” highlighting the increased competitiveness of local brands.

Global Market

In the global market, the market share of “other brands” has dropped from 15% in 2017 to 3% in 2022. This decline suggests heightened competition globally, with major companies gaining dominance in the market.

Despite the decrease in the market share of “other brands,” there is observable growth, particularly in Chinese brands. In 2022, Chinese brands make up 40% of the market share attributed to “other brands,” showcasing the increased competitiveness of Chinese brands in the global market.

Recommendations

To continue increasing the market share of “other brands,” the following recommendations can be considered:

1. Introduce New Products and Services: Enhance competitiveness by introducing innovative products and services to the market.

2. Increase Marketing and Advertising: Boost brand visibility by investing in marketing and advertising activities.

3. Expand Distribution Channels: Increase market access by expanding distribution channels.

Implementing these recommendations will contribute to enhancing the competitiveness of “other brands” in the market and further increasing their market share.

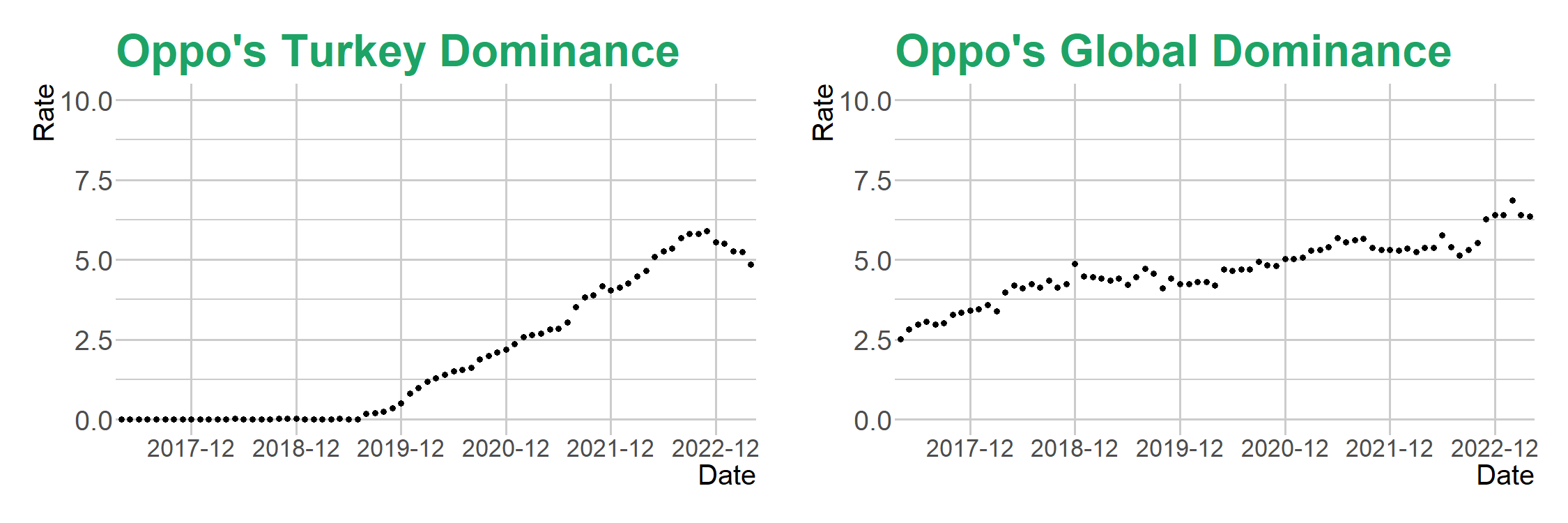

OPPO

Dominance in Turkey

The graph for Turkey illustrates Oppo’s market share steadily increasing over the years. The consistent rise, starting in 2019, resulted in a market share of 7.5% in 2022. This indicates Oppo’s emergence as one of the most popular smartphone brands in Turkey.

Global Dominance

On the global graph, Oppo’s market share has tripled from 2017 to 2022. Starting at 2.5% in 2017, the market share reached 7.5% in 2022. This signifies Oppo’s significant presence in the global smartphone market.

Comparison and Analysis

The most significant similarity between the two graphs is the consistent growth of Oppo’s market share in both markets. This suggests a robust growth trend for Oppo in the smartphone market.

Another important similarity is that Oppo needs to compete with larger brands such as Samsung and Apple in both markets. In 2022, Samsung led the global market with a 20.6% share, and Apple secured the second position with a 16.3% share, while Oppo held the fourth position with an 8% share.

An important difference between the two graphs is that Oppo’s market share in Turkey is lower than its global market share. This might be attributed to the smaller size of the smartphone market in Turkey compared to the global market.

In conclusion, Oppo demonstrates a strong growth trend in both the Turkish and global markets. While competing with larger brands like Samsung and Apple, Oppo is expected to continue being a significant player in the smartphone market.

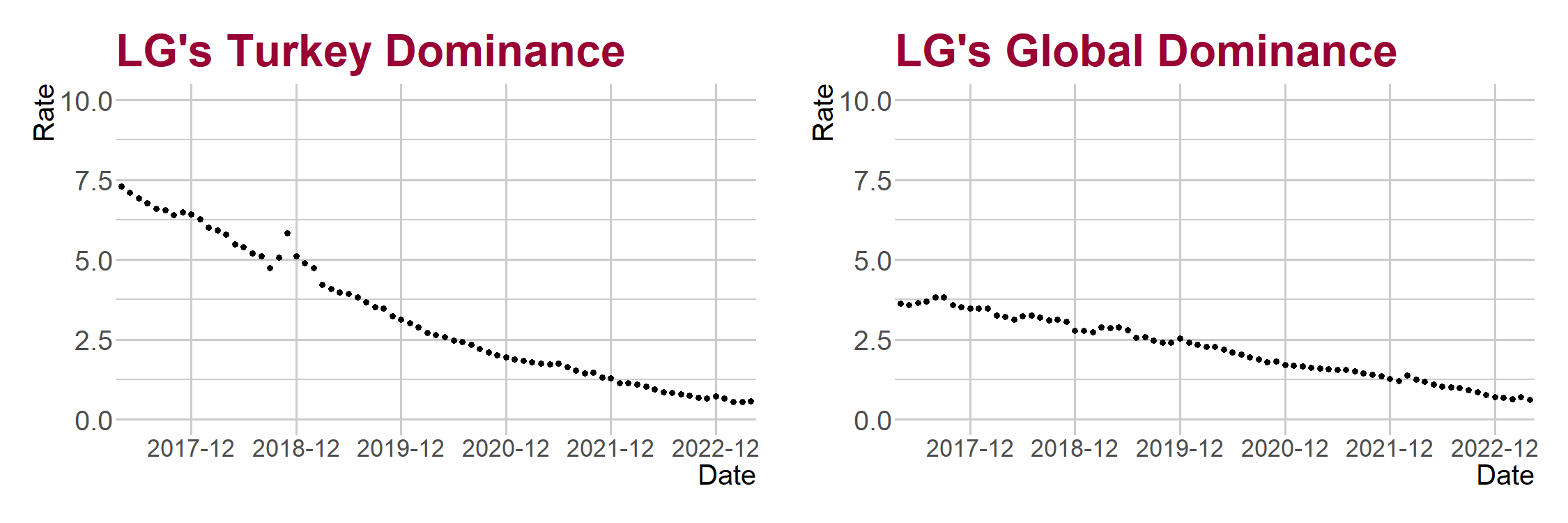

LG

Comparison

When comparing LG’s dominance in the Turkish and global smartphone markets, a similar downward trend is observed in both markets. LG has started losing its market share in the smartphone markets of both Turkey and the world, indicating a weakening position for LG as a global brand.

Detailed Analysis

Among the reasons for the decline in LG’s dominance in both the Turkish and global smartphone markets are:

1. Increased Competition: LG faces strong competition, especially against powerful rivals like Samsung and Apple in the smartphone market. This heightened competition has led to LG losing market share.

2. Difficulty Adapting to New Technologies: LG has struggled to adapt to new technologies, particularly in the smartphone market. This difficulty has contributed to LG falling behind in the smartphone market.

3. Global Economic Downturn: The global economic downturn has led consumers to reduce their spending, negatively impacting LG’s sales and market share.

In conclusion, LG’s dominance in the smartphone markets of Turkey and globally is diminishing. To halt this downward trend, LG needs to enhance its competitiveness, adapt to new technologies, and mitigate the effects of the global economic downturn.

Additional Analysis

The decline in LG’s dominance in the smartphone markets of Turkey and globally may also be influenced by the following factors:

1. Brand Image: LG’s brand image has been negatively affected in recent years. This could have diminished consumer interest in LG smartphones.

2. Marketing Strategy: LG’s marketing strategy has been insufficient in recent years, negatively impacting awareness and sales of LG smartphones.

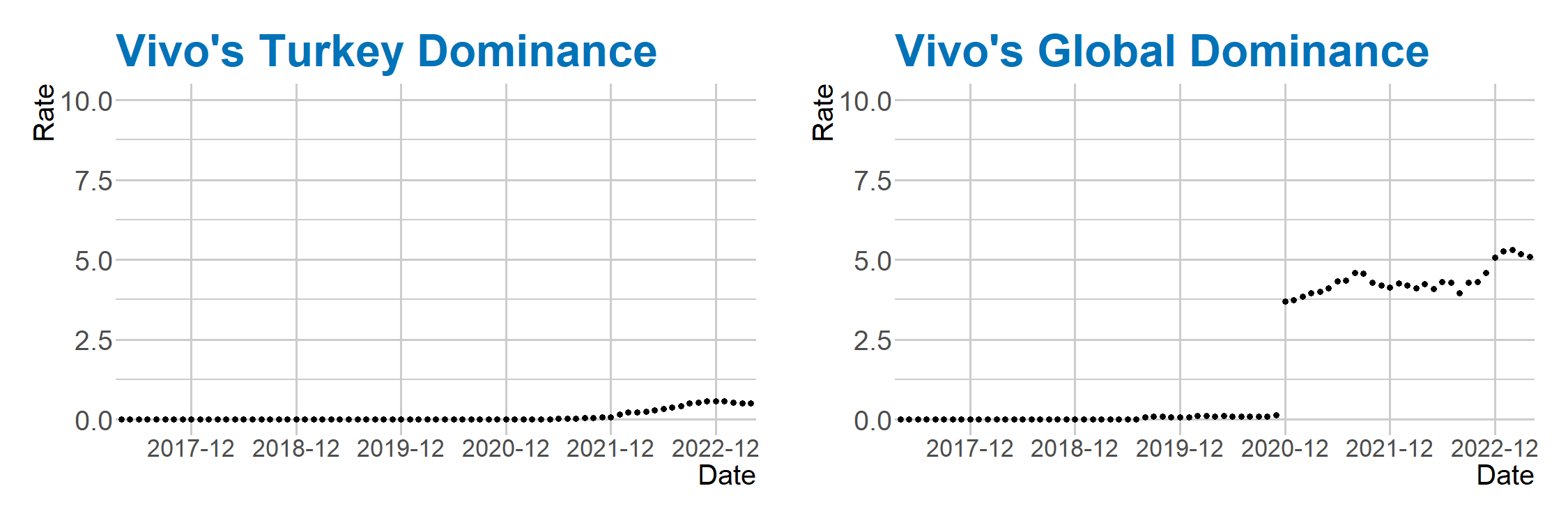

VIVO

Conclusion

Vivo demonstrates a steady increase in market share both in Turkey and globally. It is anticipated that Vivo will continue this upward trend in the future.

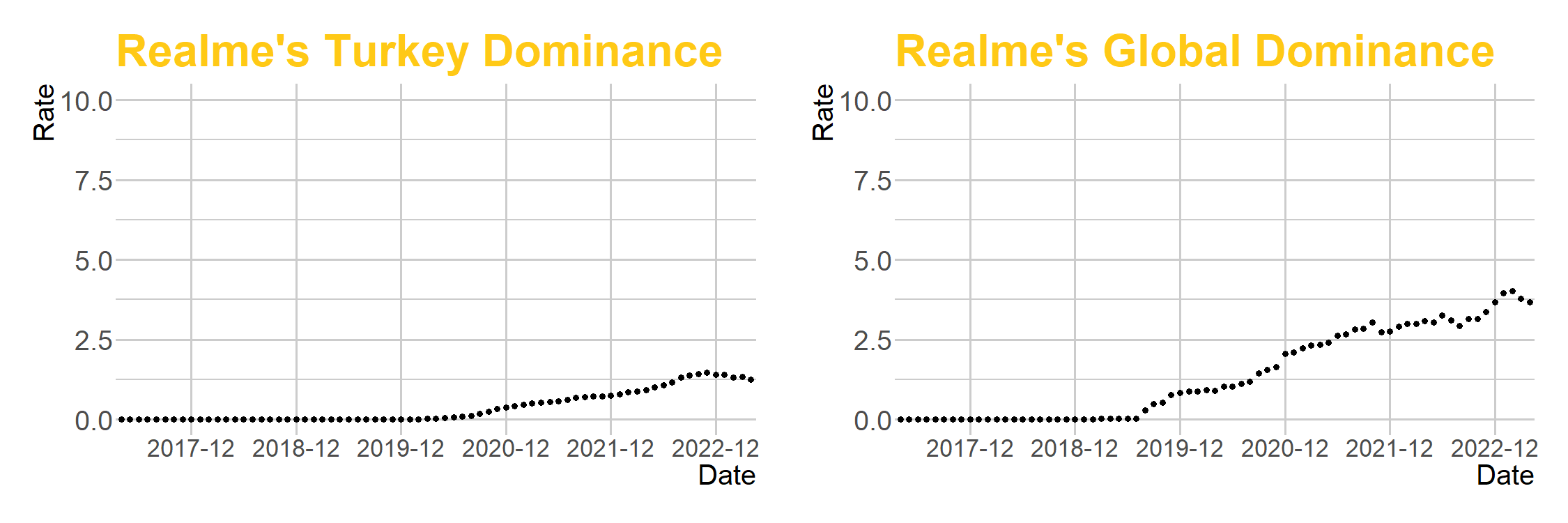

REALME

Realme’s Dominance in Turkey

The graph illustrates that Realme’s market share in Turkey has been increasing since 2019. The market share, which was 0.5% in 2019, rose to 2% by 2022, indicating that Realme is gaining strength in the Turkish market.

Global Dominance of Realme

The graph shows that Realme’s global market share has consistently increased since 2019. Starting at 1.5% in 2019, the market share reached 4% by 2022, signifying Realme’s significant presence in the global market.

Comparison and Analysis

The key difference between Realme’s dominance in Turkey and the global market lies in the pace of growth. While dominance is increasing in Turkey, it’s growing more slowly on the global stage. Several reasons may explain this difference:

1. In Turkey, Realme succeeded in increasing its market share with affordable and high-quality smartphones.

2. The growth of the smartphone market in Turkey contributed to Realme’s expansion.

3. Realme in Turkey successfully expanded its market share by increasing marketing and distribution activities.

On the global stage, Realme faced slower growth due to increased competition and market maturity. However, Realme plans to enhance its global market share by entering new markets and introducing new products and services.

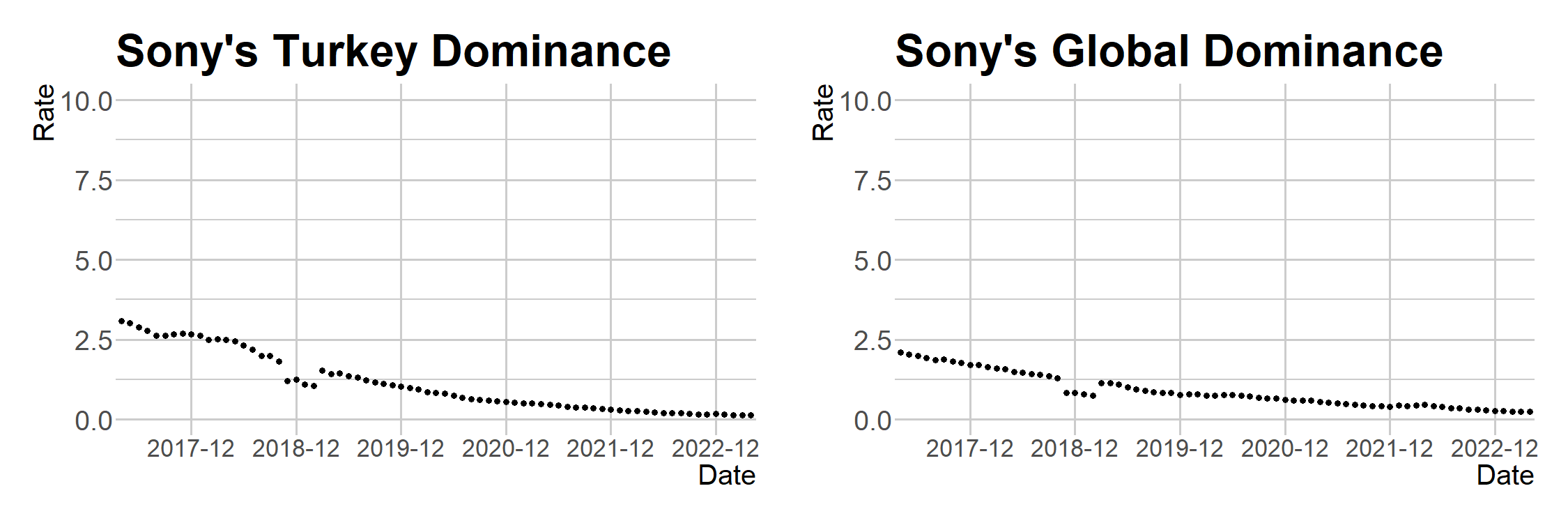

SONY

Sony’s Dominance in Turkey and Global Markets

The graph illustrates Sony’s dominance in both the Turkish and global markets, indicating a decline in market share over time.

Dominance in the Turkish Market

In the Turkish market, Sony’s dominance was 2.5% in 2017. It declined to 2.4% in 2018, 1.5% in 2019, 1.5% in 2020, 1% in 2021, and further dropped to 0.2% in 2022. This decline suggests that Sony is withdrawing from the Turkish market.

Dominance in the Global Market

In the global market, Sony’s dominance was 2.5% in 2017. It decreased to 2% in 2018, 1.5% in 2019, 1% in 2020, 0.5% in 2021, and reached 0.2% in 2022. This decline indicates increased competition in the global market.

Comparison

In terms of dominance in both the Turkish and global markets, Sony’s performance is similar. In both markets, Sony’s dominance is decreasing.

Analysis

The decline in Sony’s dominance in both Turkish and global markets can be attributed to several reasons. Firstly, increased competition in the technology sector is causing Sony to lose market share. Secondly, Sony’s success in developing innovative products has slowed down. Thirdly, Sony’s global distribution network is struggling to compete with the distribution networks of its rivals.

The decrease in Sony’s dominance in Turkish and global markets is not indicative of the company’s future success. If Sony cannot address the factors contributing to this decline, there is a risk of further loss in market share.

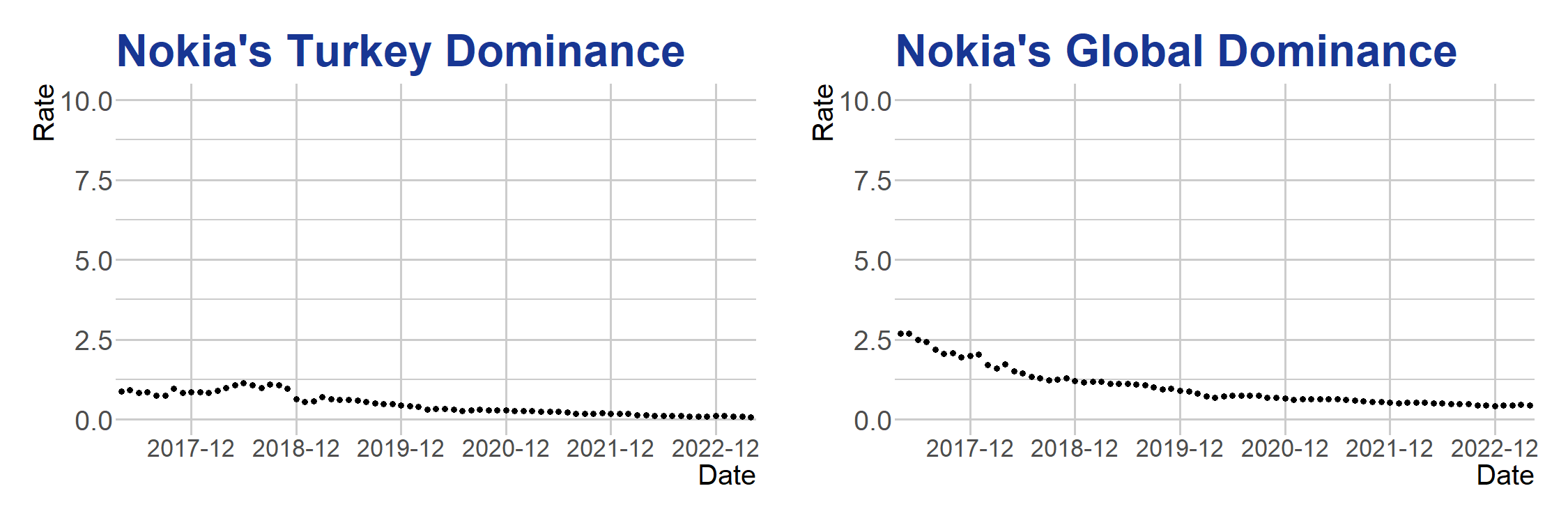

NOKIA

Nokia’s Decline in Market Dominance: A Comparative Analysis

The graphs depict a significant decline in Nokia’s dominance in both the Turkish and global markets from 2017 to 2022.

Nokia’s Dominance in Turkey

In 2017, Nokia held 1% of the market share in Turkey. This figure dwindled to 0.1% by 2022. Among the primary reasons for this decline are heightened competition, emerging technological advancements, and changes in Nokia’s marketing strategy.

Nokia’s Dominance in the Global Market

In 2017, Nokia held 2.5% of the market share globally. By 2022, this figure had decreased to 0.5%. Similar to the Turkish market, increased competition, evolving technological trends, and alterations in Nokia’s marketing strategy contributed to this decline.

Comparison

When comparing the decline in dominance in Turkish and global markets, it is evident that the drop was more dramatic globally. This could be attributed to the broader scope of the global mobile market. In Turkey, other major manufacturers like Samsung, Huawei, and Apple also hold a significant market share.

Analysis

The decline in Nokia’s market share signals the company’s loss of competitiveness in the global mobile market. To overcome this decline, Nokia should focus on developing new strategies and restructuring its marketing activities. Adopting innovative approaches and adapting to changing market dynamics will be crucial for Nokia’s resurgence in both Turkish and global markets.

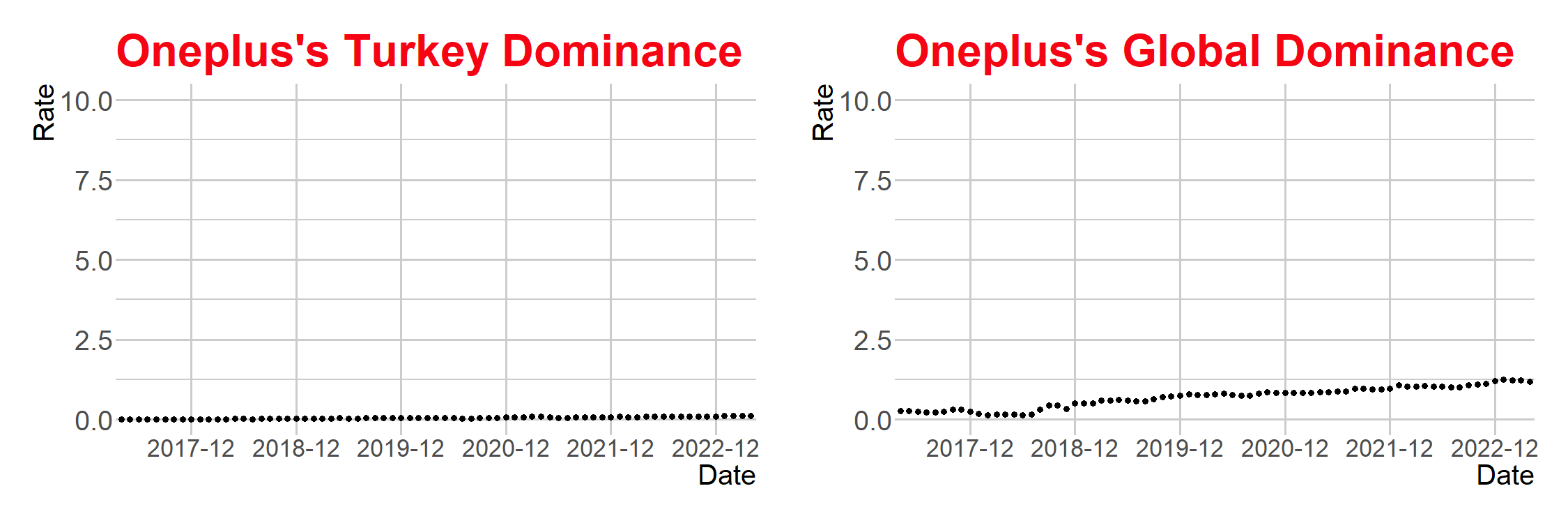

ONEPLUS

OnePlus Market Dominance in Turkey and Globally: A Comparative Analysis

In 2017, OnePlus had a 0.1% market share in Turkey, which increased to 0.2% by 2022. However, it appears that OnePlus did not achieve the targeted growth in the Turkish market.

On the global stage, OnePlus had a 0.2% market share in 2017, which rose to 1.5% by 2022. OnePlus continues to experience growth in the global market.

Comparison

The dominance of OnePlus globally is growing at a faster rate compared to its presence in Turkey. This indicates that OnePlus has more potential and appeal on a worldwide scale.

Analysis

Several factors contribute to OnePlus’s global growth. Firstly, OnePlus is known for offering affordable yet high-quality smartphones. Secondly, OnePlus has a robust marketing campaign. Thirdly, OnePlus benefits from the increasing demand for smartphones in both the Turkish and global markets.

The expansion of OnePlus is positive news for both the Turkish and global smartphone markets. OnePlus’s growth is expected to enhance competition and provide consumers with more choices. The company’s ability to offer competitive products at attractive prices and its effective marketing strategies contribute to its success on a global scale.

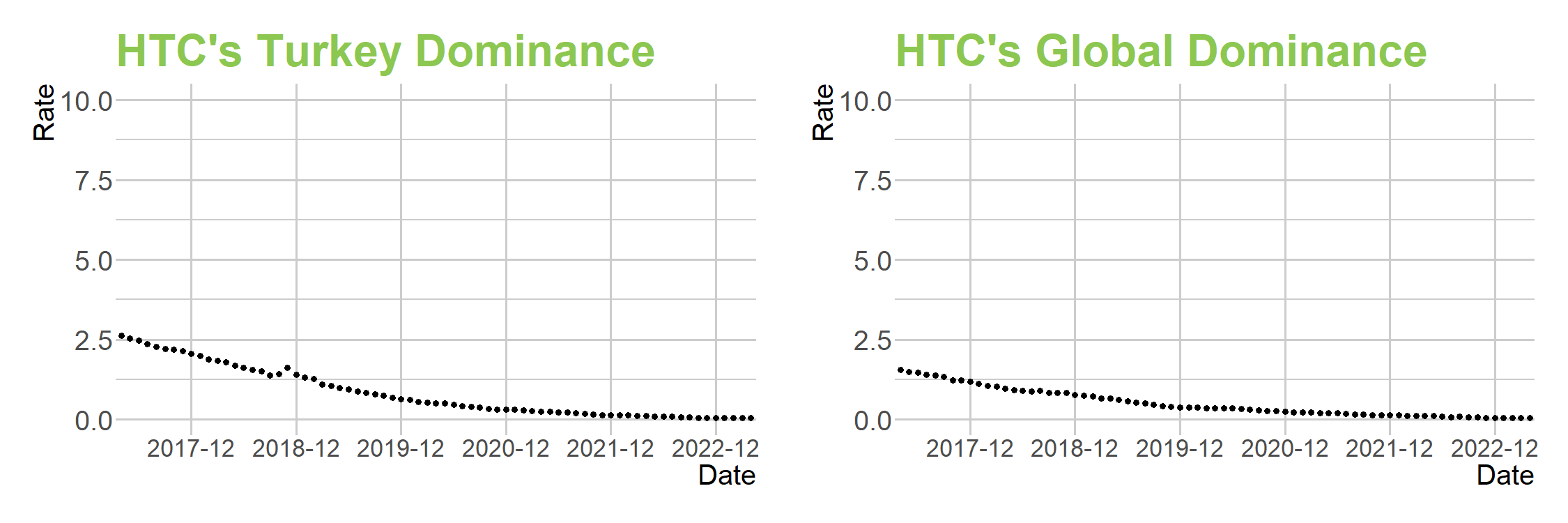

HTC

HTC’s Market Dominance in Turkey and Globally: A Comparative Analysis

Between 2017 and 2022, HTC held a significant share in the Turkish smartphone market. In 2017, HTC’s market share in Turkey was 2.5%, which declined to 0.1% by 2022. The decrease in HTC’s market share in Turkey can be attributed to the company’s withdrawal from the Turkish market, increased competition from rival firms, and HTC’s failure to innovate successfully.

On a global scale, HTC also experienced a decline in market share from 2.2% in 2017 to 0.1% by 2022. The global decline in HTC’s market share can be explained by intensified competition from rival firms and HTC’s lack of success in developing innovative products.

Comparison

There are some similarities in HTC’s dominance in both the Turkish and global markets. In both markets, HTC’s market share decreased from 2017 to 2022.

However, there are significant differences between the two markets. The more pronounced decline in Turkey suggests that HTC is less competitive in the Turkish market compared to the global market.

Analysis

The decline in HTC’s market dominance in Turkey and globally raises significant concerns for the company’s future. To counteract this decline, HTC should focus on developing innovative products and enhancing competitiveness against rival firms.

Increasing Research and Development (R&D) investments could allow HTC to develop innovative products that stand out in the market. Additionally, expanding into new markets may help HTC increase its competitiveness against rival firms.

By taking these measures, HTC can regain its market dominance in both the Turkish and global markets. Adopting a proactive approach to innovation and market expansion will be crucial for HTC’s future success.

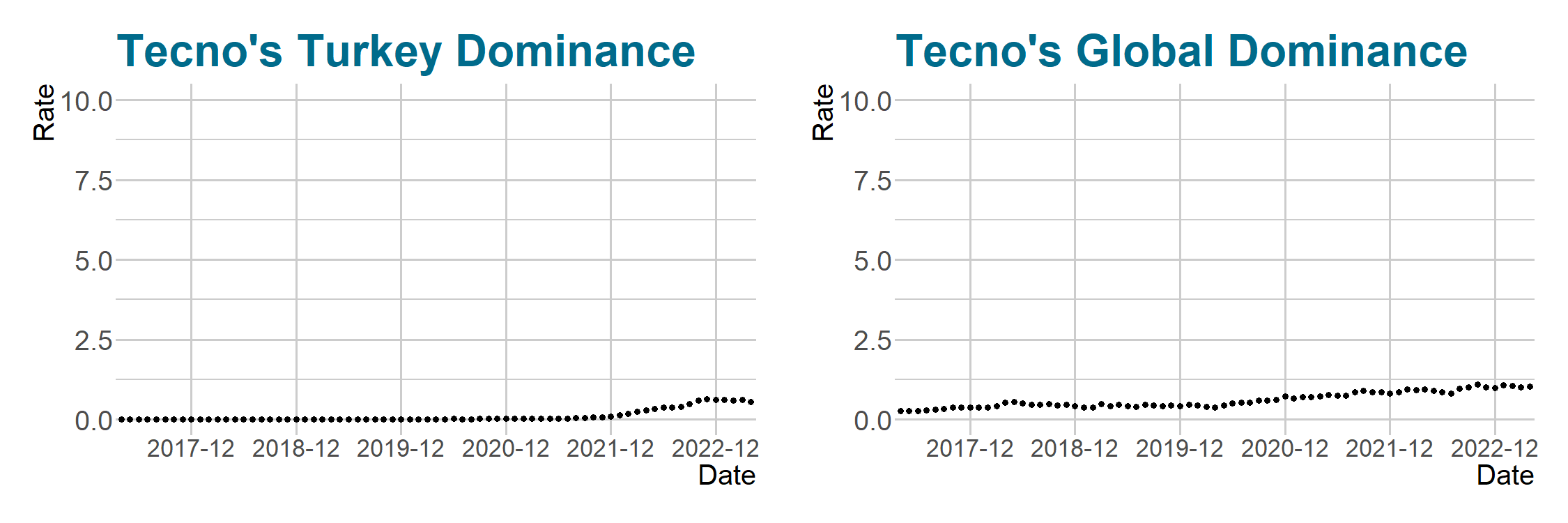

TECNO

Tecno’s Dominance in Turkey and Global Markets: A Comprehensive Analysis

Between 2017 and 2022, Tecno’s dominance in the Turkish smartphone market increased significantly from 0.1% to 0.7%. This growth indicates Tecno’s successful efforts in expanding its market share in Turkey. Key factors contributing to Tecno’s increased market share include offering budget-friendly and high-quality smartphone models, conducting robust marketing campaigns, and expanding distribution channels in Turkey.

On the global stage, Tecno’s dominance also witnessed substantial growth, rising from 0.2% in 2017 to 1.5% in 2022. This demonstrates Tecno’s emergence as a noteworthy player in the global market. The primary reasons behind Tecno’s global dominance include capitalizing on the growing demand for low-cost smartphones and accelerating its growth in developing markets such as Asia and Africa.

Comparison

While Tecno’s dominance in Turkey is lower than its global presence, the rate of growth in Turkey surpasses that on the global scale. This suggests that Tecno has higher potential to increase its market share in Turkey.

Analysis

The increasing dominance of Tecno in both Turkish and global markets signifies the company’s pivotal role in the smartphone industry. To sustain this success, Tecno must continue to offer budget-friendly and high-quality smartphone models, execute strong marketing campaigns, and expand distribution channels.

Recommendations

To enhance Tecno’s dominance in both the Turkish and global markets, the following recommendations can be considered:

1- Develop a Targeted Strategy for Turkey:

- Create a specific strategy for increasing market share in Turkey.

- Focus on providing budget-friendly and high-quality smartphone models, conducting robust marketing campaigns, and expanding distribution channels.

2- Accelerate Growth in Developing Markets:

- Concentrate on developing markets such as Asia and Africa to accelerate global growth.

3- Invest in Research and Development:

- Allocate resources to research and development to stay abreast of new technologies and industry trends.

By implementing these recommendations, Tecno can solidify its position in both the Turkish and global smartphone markets and continue its upward trajectory in market dominance.

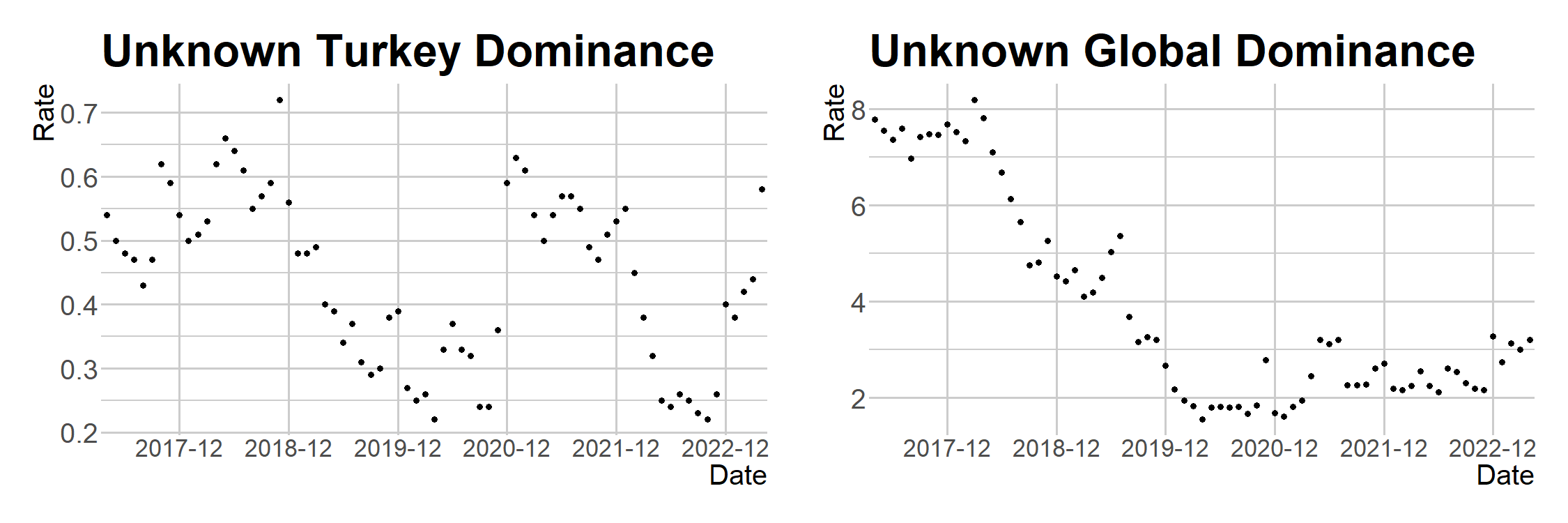

BONUS : UNKNOWN

Comparison of Unknown Phone Dominance in Turkey and Worldwide

Turkey:

Unknown phone dominance in Turkey started at around 0.7% in 2017 and followed a fluctuating trend. Despite a decrease in 2019, it reached 0.5% again by 2022, indicating an increase in the use of illicit phones. The main reasons for the rise in illicit phone usage in Turkey include:

- High taxes on mobile phones in Turkey.

- High prices of mobile phones in Turkey.

- Lack of supervision in the mobile phone market in Turkey.

Worldwide:

Unknown phone dominance globally started at a considerably high level of 8% in 2017 and decreased to around 3-4% by 2022. Some reasons for illicit phone usage worldwide include:

- High taxes on mobile phones globally.

- High prices of mobile phones globally.

- Lack of supervision in the global mobile phone market.

Analysis and Evaluation of Data:

The increase in illicit phone usage in Turkey and worldwide leads to several problems:

- Loss of Government Revenue:

- High taxes and illicit usage contribute to significant losses in government revenue.

- Unfair Competition for Mobile Phone Manufacturers:

- The lower cost of illicit phones creates unfair competition for legal manufacturers.

- Consumer Disadvantages Due to Low Quality:

- Illicit phones often have lower quality, leading to disadvantages for consumers in terms of performance and warranty.

Suggested Solutions:

To reduce illicit phone usage and address these problems, the following measures can be taken:

- Reducing Taxes on Mobile Phones:

- Lowering tax rates can decrease the incentive for illicit phone usage.

- Lowering Prices of Mobile Phones:

- Price reductions can shift consumers towards legal channels and away from illicit options.

- Increasing Market Supervision:

- Enhanced supervision and regulation of the mobile phone market can help control illicit activities.

Taking these measures can not only reduce illicit phone usage but also mitigate the associated problems such as government revenue loss, unfair competition, and consumer dissatisfaction.